Research Article: 2019 Vol: 23 Issue: 3

Factors That Influence the Use of Computer Assisted Audit Techniques (CAATs) By Internal Auditors in Jordan

Ahmad Al-Hiyari, Aldar University College

Nidal Al Said, Ajman University

Ezz Hattab, Aldar University College

Abstract

Despite the speed of technological and digital advances and the increase in stakeholder expectations, the recent studies shown that the actual use of Computer-Assisted Auditing Techniques (CAATs) by internal auditors remains unsatisfactory, and there is a paucity of evidence on the factors that may drive internal auditor's intention to accept and utilize CAATs in developing countries. A better understanding of these factors can aid policy makers to proactively design interventions (e.g., marketing, training etc.) to increase the utilization of CAATs. Borrowing from Information Systems (IS) research, we employ the Unified Theory of Acceptance and Use of Technology (UTAUT) to examine the determinants of intention to adopt CAATs by internal auditors. Using 105 valid responses from internal auditors in Jordan, the paper found that CAATs adoption is influenced by performance expectancy and effort expectancy. The results suggest that policy makers should encouraged internal auditors to adopt CAATs by educating them as to the benefits of using these automated tools, by dedicating more recourse to invest in technical infrastructure, by improving their skills through increased CAATs training programmes, and by developing reward systems that encourage auditors to use CAATs.

Keywords

Computer-Assisted Auditing Techniques (CAATs), Marketing, Training

Introduction

Significant innovations in technology and software solutions have been launched in recent years to enhance the effectiveness and efficiency of audit procedures. Given the potential benefits of technology on the audit process, auditing standards have increasingly encouraged auditors to innovate and transform their methods in order to meet the stakeholders’ expectations (Braun & Davis, 2003; Curtis & Payne, 2014; Debreceny et al., 2005). Notable among the major technological developments and tools are Computer-Assisted Auditing Techniques (CAATs), which are used by auditors to support various audit processes by analysing data for the audit (IIA, 2018).

The use of CAATs may provide several advantages over traditional audit. First, traditional audit depends on extracting sample data sets and extrapolating conclusions about the population of transactions. By contrast, CAATs permit auditors to test the entire population of data and transactions, leading to more comprehensive tests and higher quality audit evidence (Singleton, 2006). Second, unlike traditional audit, CAATs enable auditors to test the entire data and transactions quickly, thus, give greater opportunity for them to perform better informed risk assessments. As a result, the auditors responsive to those risks are more focused and effective (The World Bank, 2017). This is particularly important as auditors faced with increased in workloads and expectations from stakeholders related to the scope and value of the audit (Ernst & Young, 2015; Ghosh & Pawlewicz, 2009). Third, CAATs are robust audit tools to detect errors and fraud such as the existence of duplicate transactions, missing transactions and anomalies (Coderre, 1999). Therefore, auditors should utilize computer software applications in order to conduct the audit procedures in an efficient and effective manner. (Braun & Davis, 2003)

Despite the tremendous advantages of using CAATs in all audit engagements (Bierstaker et al. 2014), numerous recent studies suggest that the use of CAATs by internal auditors remains unsatisfactory (Dias & Marques, 2018; KPMG, 2015; Li et al., 2018). For example, KPMG (2015) found that majority of internal auditors cannot use data analytics effectively to accomplish their tasks, or they utilize it on an ad-hoc manner. In a related study, Dias & Marques (2018) found that majority internal auditors in Portugal are using basic audit analytics technique (e.g., Microsoft excel) to support the audit procedures.

Meanwhile, extant research explored the determinants of auditor’s acceptance of new technology in developed countries (Bierstaker et al., 2014; Curtis & Payne, 2014; Debreceny et al., 2005; Gonzalez et al., 2012; Mahzan & Lymer, 2008: 2014). For example, Debreceny et al. (2005) documented that internal auditors in Singapore perceived generalized audit software (GAS) as a tool for fraud detections rather than a basis to support their day-to-day audit activities. Mahzan & Lymer (2014) studied the factors that affect internal auditor’s decisions to adopt CAATs in the UK and Malaysia. They showed that auditors skills and knowledge in technology and their perception regarding the importance of using technology to perform the audit procedures in an efficient and effective way play a vital role in influencing internal auditors' intentions to utilize CAATs. Bierstaker et al. (2014) surveyed external auditors in U.S. and documented that the facilitating conditions and the performance expectancy are associated with increased acceptance and use of CAATs.

Nevertheless, previous research offers limited evidence on the factors influencing successful adoption of CAATs by internal auditors in different institutional environments, mainly in developing countries. To address this void, we extend the literature by exploring the determinants of CAATs adoption by internal auditors in the context of Jordan. The cultural and institutional environment in Jordan has considerable implications for the decisions of internal auditors on whether to accept and use CAATTs or not. This includes weak internal audit function (Cigna & Sigheartau, 2016), lax enforcement of accounting regulation (Al-Akra, Jahangir Ali, & Marashdeh, 2009), the unique cultural features in Jordan which characterized by a high power distance and uncertainty avoidance. These institutional features provide a good basis to investigate the factors that affect the decisions of internal auditors to adopt CAATs.

Scholars from the disciplines of information systems (IS) have stressed on the usefulness of using information technology (IT) in business and the theories used in the IS studies give a foundation for investigating the issue in the context of internal audit (Curtis & Payne, 2008). In this paper, we use Unified Theory of Acceptance and Use of Technology (UTAUT) to study the determinants of CAATs adoption by internal auditors in Jordan. The UTAUT model is developed by Venkatesh et al. (2003) and offers a theoretical basis upon which to examine the adoption and usage of a certain type of technology (Gonzalez et al., 2012). Understanding the determinants of adopting technology allows internal audit departments to proactively create interventions (e.g., marketing, training, etc.) addressed at populations of internal auditors that may be less motivated to accept and utilized technology (Venkatesh et al., 2003).

This study focuses on internal auditors for many reasons. First, while several studies examine CAATs usage by external auditors (Ahmi & Kent, 2012; Bierstaker et al., 2014; Braun & Davis, 2003; Curtis & Payne, 2008; Janvrin, Bierstaker, & Lowe, 2008; Janvrin, Lowe, & Bierstaker, 2008), few academic studies investigate the acceptance of CAATs by internal auditors despite its important in improving the quality of audit. Second, the structures and objectives of internal auditors differ much from that of the external auditors. Therefore, the factors that lead to adopt CAATs will be different for different types of auditors (Ahmi & Kent, 2012). Finally, internal auditors have diverse responsibilities ranging from financial matters to operational and compliance matters. (Arens et al., 2012). Thus, they may have more incentives to accept and use CAATs in order to carry out the audit procedures effectively.

The remaining sections of this paper is structured as follows. Section 2 reviews previous studies relevant to this research. Section 3 develops research hypotheses. Next, we discuss the research methodology in Section 4, while the Section 5 offers the results of our study. Finally, we discuss the major results in Section 6 and conclude this paper in Section 7.

Literature Review

Most of the prior researches focus mainly on external auditors and their intention to adopt CAATs (Ahmi & Kent, 2012; Bierstaker et al., 2014; Braun & Davis, 2003; Curtis & Payne, 2008; Janvrin, Bierstaker, et al., 2008; Janvrin, Lowe, et al., 2008). For instance, Bierstaker et al. (2014) surveyed 181 auditors to investigate the factors that may affect auditors' acceptance or non-acceptance of CAATs. They found evidence that facilitating conditions and performance expectancy increased the likelihood that auditors will adopt CAATs. They recommend that audit firms should develop training programs to raise the expectations of auditors about the contribution of CAATs to their job performance. They also recommend that audit firms should invest more in technical infrastructure in order to encourage the auditors to accept CAATs. Similarly, Braun & Davis (2003) carried out interview with practicing auditors regarding their experience with CAATs. They found that auditors exhibit lower confidence in their technical ability in applying CAATs. They recommend additional training programmes to boost the confidence of the auditors to use these automated tools.

Curtis & Payne (2008) carried out an experiment, which reveals that auditors are more likely to utilize new audit technology when the firm’s managing partner/CEO is encouraging the use of the audit software and when the firms have longer-term budgets and evaluation periods. Because employing longer budgetary time periods will provide a means of spreading the cost of technology across several years. Thus, the cost of technology to be spread across several years. Therefore, decreasing the effect on the first year. Interestingly, they documented the decision to utilize new technology is associated with the characteristics of the auditors. That is, high risk preference auditors are more likely to utilize new audit technology, regardless of the firm budget pressure. In another study, Ahmi & Kent (2012) conduct questionnaire with statutory auditors in the UK to gain insight into the factors that influence their utilization of GAS. Results show that utilization of GAS is relatively low and the factors that influence GAS usage include client’s environment, job relevance to auditors, cost and resources that are required to implement GAS, auditor’s experience and knowledge, IT infrastructure, and top management support.

Previous studies have recognized the importance of incorporating computerized techniques in the audit process. Further, they have thoroughly investigated the several factors that affect CAATs adoption by external auditors. However, this paper examines the influence of Jordanian internal auditors' acceptance and use of CAATs in audit procedures. Dias & Marques (2018) employed survey questionnaire on 51 internal auditors in Portugal to identify the automated tools that are mostly utilized by internal auditors and to investigate the factors influencing the use of audit software. They found that a vast majority of the auditors used a tool developed internally by the firm. This suggests that firms favour to invest in-house software in order to ensure efficient use of the firm resources while aligning the functionalities of the tools with the corporate objectives and strategies. In addition, their study showed that the audit experience, the existence of CAATs in the company and size of the internal audit department are associated with increased use of IT tools to support auditing.

Previous studies have examined the factors that drive audit software adoption at both individual and organizational levels. For example Li et al. (2018) adopted the Technology- Organization-Environment (TOE) framework to investigate the factors that drive audit analytics utilization at the organizational level. They found evidence that the decision of internal auditors to use data analytics is influenced by encouragement by top managements, professional help and technological competences. They also perceived that audit analytics as important technique in enhancing the effectiveness of the internal audit process. On the other hand, Mahzan & Lymer (2014) examined the factors at the individual level that affect the decisions of internal auditors to adopt CAATs when performing their duties. Based on the UTAUT framework, Mahzan & Lymer (2014) analysed respondents' answers and found evidence that the main motivations for CAAT adoption are facilitating conditions and performance expectancy. Their findings are consistent with the notion that CAATs usage can improve the efficiency of the auditors’ job and their skills and knowledge play an important role when deciding whether to adopt CAATs in applications in the audit process.

Research Model and Hypotheses

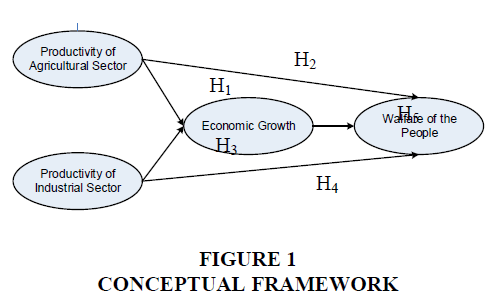

While a number of theories have been employed in the IS studies to illustrate the factors that influence an individual to adopt a particular technology, we choose the UTAUT model as it incorporates constructs from several prominent theories. These theories are Theory of Reasoned Action (TRA) (Ajzen & Fishbein, 1980), Social Cognitive Theory (SCT) (Compeau & Higgins, 1995), Motivational Model (MM) (Davis et al., 1992), Theory of Planned Behaviour (TPB) (Ajzen, 1991), Model of PC Utilization (Thompson et al., 1991), Technology of Acceptance Model (TAM) (Davis, 1989), Innovation Diffusion Theory (IDT) (Moore & Benbasat, 1991), and a model combining TMA and TPB (Taylor & Todd, 1995). In addition, the UTAUT model provides better explanatory power in illustrating the behavioural intention to use a system than the other theories (Martins et al., 2014). Thus, the UTAUT is the most complete model to examine the determinants of Jordanian internal auditors' acceptance and utilize of CAATs in audit procedures. Finally, much of the empirical literature have supported the appropriateness of the UTAUT model in predicting an individual intention to use a technology in different contexts (Curtis & Payne, 2014; Mahzan & Lymer, 2014; Martins et al., 2014). Figure 1 shows the research model proposed to explore the determinants of CAATs adoption by internal auditors in Jordan. All variables used in this research are explained next.

Performance expectancy

Performance expectancy (PE) refers to the individual beliefs that utilizing a new technology will assist him or her to achieve gain in job performance (Venkatesh et al., 2003). CAATs are likely to provide internal auditors with several benefits. For instance, the automated tools allow auditors to examine 100% of the transactions rather than a sample, making it more difficult for fraudsters to conceal their fraud (Singleton, 2006). In addition, CAATs may assist internal auditors to analyse large volumes of transactions quickly (KPMG, 2015). This will in turn enable auditors to focus more on high-risk areas (The World Bank, 2017), leading to an improvement in audit efficiency and effectiveness (Dias & Marques, 2018). As a result, CAATs are seen to be crucial tool to support an internal auditor’s work (Mahzan & Lymer, 2014).

Given these benefits, internal auditors are more likely to accept and utilize CAATs if they believe that traditional audit techniques are not going to support them with achieving desired improvement in job performance. Consistent with the arguments outlined above, we predict that performance expectancy will be positively related to internal auditors' intentions to adopt CAATs. Therefore, we posit the following hypothesis:

H1: Performance expectancy has a positive influence on internal auditors' intentions to adopt CAATs in Jordan.

Effort expectancy

Although an individual may perceive that utilizing a particular technology is an important in achieving desired outcomes, they might also perceive that the system is too hard to utilize (Davis, 1989). Effort expectancy (EE) captures the level of ease accompanying the use of the technology (Venkatesh et al., 2003), and the degree to which an individual perceive that using it would be effortless (Davis, 1989). Within this context, the utilization of CAATs by internal auditors has fundamentally changed the nature of the audit from a traditionally manual approach to an automated approach (Ernst & Young, 2015). This change adds some complexities to the internal auditor’s work (Pedrosa & Costa, 2012). For instance, auditor must first prepare for the application of the selected CAATs and check the integrity of the information system from which the data are extracted. Then, they must obtain access to data in order to performing the audit (Sayana, 2003). Yet due to the lack of internal auditor’s knowledge and experience in audit software (KPMG, 2015), adoption of CAATs require internal auditors to overcome learning curve in order to become skilful at utilizing these automated tools (Gonzalez et al., 2012).

The aforementioned barriers may increase internal auditor’s effort expectancy for CAATs adoption. As such, the likelihood those internal auditors would accept and use CAATs increased inasmuch as they believe that system is easy to use and effort-free (Mahzan & Lymer, 2014). Prior research found that effort expectancy is an important factor in predicting internal auditors' intentions to use continuous auditing (Gonzalez et al., 2012). Hence, the next hypothesis is:

H2: Effort expectancy has a negative effect on internal auditors' intentions to adopt CAATs in Jordan.

Social influence

Social influence (SI) reflects the extent to which an individual view that the crucial others (e.g., relatives and superiors) think that he or she should utilize a system (Venkatesh et al., 2003). Prior research has proven that social influence has an important influence on user’s intention to accept and utilize a technology (Kesharwani & Bisht, 2012; Zuiderwijk et al., 2015). In an audit context, social influence comes from the head of internal audit department, audit committee, or other people who may affect the decision of internal auditors on whether to accept and use CAATTs or not (Mahzan & Lymer, 2014). Prior research found evidence supporting the notion that social influence had a strong effect on the behavioural intentions of internal auditors to adopt CAATs (Curtis & Payne, 2008; Gonzalez et al., 2012). Thus, we expect that internal auditors are more likely to adopt CAATs if they perceive that their direct supervisors support CAATs usage (Bierstaker et al., 2014). Hence, we propose the following hypothesis:

H3: Social influence has a positive effect on internal auditors' intentions to adopt CAATs in Jordan.

Facilitating conditions

Facilitating conditions (FC) refer to the extent to which a person believe that enough resources and technical infrastructure are available to support system utilization (Venkatesh et al., 2003). In an audit context, CAATs require internal auditors to have certain skills such as defining input files and designing complex commands to perform the tests (Braun & Davis, 2003). Thus, investing more resources in IT-related audit training is necessary to facilitate for internal auditors using CAATs (Sayana, 2003). According to Mahzan & Lymer (2014), facilitating conditions such as organization’s IS facilities and support from top managers; as well as support from software providers are vital to facilitate the adoption of CAATs. If internal auditors do not have these facilitating conditions, they will not accept or utilize CAATs. Prior research documented that facilitating conditions had strong effect on internal auditors' intentions to adopt CAATs (Bierstaker et al., 2014; Mahzan & Lymer, 2014). Based on the aforementioned explanation, the following hypothesis is formulated:

H4: Facilitating conditions have a positive effect on internal auditors' intentions to adopt CAATs in Jordan.

Methodology

Sample and Conduct of Survey

An online survey was carried out to test the hypotheses. This method was proven to be the most efficient and appropriate way to gather the data quickly from Jordanian internal auditors. A total of 344 internal auditors in Jordan, mainly ACL users who are clients of Zee Dimension Company (ACL channel partner for Jordan) were contacted by e-mail and supplied with the hyperlink of the survey. From this initial sample, 123 valid responses were received from internal auditors. A detailed inspection of these responses revealed that 18 participants did not answer the entire items in the survey and are therefore excluded from this study, leaving a final sample of 105 valid responses.

The survey was developed from prior research (Venkatesh et al., 2003). It consists of two parts. The first part includes items on demographic characteristics of respondents. The second part contained the five constructs obtained from the UTAUT. These constructs include intention to use CAATs, facilitating conditions (FC) effort expectancy (EE), performance expectancy (PE) and social influence (SI). Internal auditors were asked to assess the factors that affect CAATs adoption decisions on a five-point Likert Scale ranging from 1 (‘totally disagree’) to 5 (‘totally agree’).

Table 1 present the demographic profile of respondents. The demographics indicate that the vast majority of the respondents were male (67.6%), aged between 30 to 39 years old (41.9%) and had a bachelor’s degree (68.4%) with experience as internal auditor of 10 to 14 years (41.9%). Further analysis shows that 59% of participants are using CAATs in their firms as voluntary activity while 41% of them are using it as a mandatory activity.

| Table 1 Demographics Characteristics of Study Respondents (N=105) | |||

| Characteristics | Details | Frequencies | Percent |

| Gender | Male | 71 | 32.4 |

| Female | 34 | 67.6 | |

| Education | Diploma or below | 1 | 1.0 |

| Bachelor degree | 71 | 68.4 | |

| Master degree | 29 | 26.8 | |

| PhD | 4 | 3.8 | |

| Experience in current position | Less than 5 years | 8 | 7.6 |

| 5 to 9 years | 14 | 13.3 | |

| 10 to 14 years | 44 | 41.9 | |

| 15 or above | 39 | 37.1 | |

| Age | Less than 30 years | 10 | 9.5 |

| 30–39 years | 44 | 41.9 | |

| 40–49 years | 31 | 29.5 | |

| 50 and above years | 20 | 19.0 | |

Measures and Descriptive Statistics

Table 2 provides the descriptive statistics for the questions listed in the survey. The table shows a fairly unequal-mean score across various constructs, with performance expectancy (4.021) receiving higher mean score from the respondents than effort expectancy (3.836), social influence (3.770) and facilitating conditions (3.531). These descriptive statistics suggest that auditors perceive that using CAATs will aid them to achieve desired gain in job performance.

| Table 2 Construct Items Means and Standard Deviation | ||||

| Constructs | Item | Definition | Mean | Std. dev. |

| Performance expectancy | Q1. | I would find the computer-assisted audit techniques useful in my job. | 4.181 | 0.568 |

| Q2. | Using the computer assisted audit techniques enables me to accomplish tasks more quickly | 4.095 | 0.643 | |

| Q3. | Using the computer assisted audit techniques increases my productivity | 4.076 | 0.703 | |

| Q4. | If I use the computer assisted audit techniques, I will increase my chances of getting a raise. | 3.810 | 0.708 | |

| Q5. | Using the computer assisted audit techniques would reduce the time I spend on unproductive activities | 3.971 | 0.713 | |

| Q6. | Using the computer assisted audit techniques would increase the quality of the audit | 3.990 | 0.753 | |

| Mean and standard division of performance expectancy | 4.021 | 0.545 | ||

| Effort expectancy | Q7. | My interaction with the computer-assisted audit techniques would be clear and understandable | 3.867 | 0.666 |

| Q8. | It would be easy for me to become skillful at using the computer assisted audit techniques. | 3.867 | 0.785 | |

| Q9. | I would find the computer -assisted audit techniques easy to use | 3.838 | 0.735 | |

| Q10. | Learning to operate the computer -assisted audit techniques is easy for me. | 3.857 | 0.713 | |

| Q11. | Using the computer - assisted audit techniques may require a lot of my mental effort | 3.752 | 0.782 | |

| Mean and standard division of effort expectancy | 3.836 | 0.600 | ||

| Social influence | Q12. | People who influence my behavior think that I should use the computer -assisted audit techniques | 3.686 | 0.788 |

| Q13. | People who are important to me think that I should use the computer -assisted audit techniques | 3.781 | 0.796 | |

| Q14. | The senior management of this business has been helpful in the use of the computer -assisted audit techniques. | 3.743 | 0.821 | |

| Q15. | In general, the organization has supported the use of the, computer -assisted audit techniques. | 3.857 | 0.777 | |

| Q16. | People in my organization who use computer -assisted audit techniques have more prestige than those who do not use it. | 3.781 | 0.747 | |

| Mean and standard division of social influence | 3.770 | 0.686 | ||

| Facilitating conditions | Q17. | I have the resources necessary to use the computer -assisted audit techniques. | 3.838 | 0.798 |

| Q18. | I have the knowledge necessary to use the computer-assisted audit techniques | 3.848 | 0.704 | |

| Q19. | The system is not compatible with other computer-assisted audit techniques I use. | 2.533 | 0.941 | |

| Q20. | A specific person (or group) is available for assistance with computer-assisted audit techniques difficulties | 3.629 | 0.697 | |

| Q21. | I think that using the computer-assisted audit techniques fits well with the firm’s audit approach | 3.810 | 0.681 | |

| Mean and standard division of facilitating conditions | 3.531 | 0.471 | ||

| Behavioral intention to use CAATs | Q22. | I intend to use the computer-assisted audit techniques on this year’s engagement | 3.790 | 0.817 |

| Q23. | I predict I would use the computer-assisted audit techniques in the coming future | 3.962 | 0.706 | |

| Q24. | I plan to use the computer-assisted audit techniques on this year’s engagement | 3.819 | 0.757 | |

| Mean and standard division of behavioral intention to use CAATs | 3.857 | 0.696 | ||

Data Analysis

Analysis method

Partial least squares (PLS) method was employed to assess the reliability and validate the measures. The advantages of this method is that it allows for an increased accuracy in the estimation of model (Cramer, 1993). Likewise, PLS can jointly test the measurement and the structural models, generating a more complete data analysis (Azmi et al., 2016). PLS also can run with small sample sizes and require lower demand on the distribution of the residuals (Chin, Marcelin, & Newsted, 2003). Hence, smart PLS was utilized in this study to analyse the data and to test the proposed hypotheses.

Construct Reliability and Validity

Before testing the hypotheses, it is essential first to examine the measurements model by assessing the convergent and discriminant validity. Convergent validity is the extent to which the questions that are supposed to be correlated with the same construct are, actually, correlated (Carlson & Herdman, 2012). To examine the convergent validity, the study employed the outer loadings of the items, the average variance extracted (AVE), and the composite reliability (CR) as presented in Table 3.

| Table 3 Convergent Validity | ||||

| Constructs | Items | Outer Loadings | Composite reliability | Average variance extracted |

| Performance expectancy (PE) | Q1. | 0.789 | 0.923 | 0.705 |

| Q2. | 0.847 | |||

| Q3. | 0.852 | |||

| Q4. | 0.632 | |||

| Q5. | 0.781 | |||

| Q6. | 0.881 | |||

| Effort expectancy (EE) | Q7. | 0.874 | 0.928 | 0.762 |

| Q8. | 0.851 | |||

| Q9. | 0.877 | |||

| Q10. | 0.856 | |||

| Q11. | 0.608 | |||

| Social influence (SI) | Q12. | 0.878 | 0.939 | 0.755 |

| Q13. | 0.820 | |||

| Q14. | 0.885 | |||

| Q15. | 0.893 | |||

| Q16. | 0.868 | |||

| Facilitating conditions (FC) | Q17. | 0.837 | 0.901 | 0.659 |

| Q18. | 0.851 | |||

| Q19. | -0.336 | |||

| Q20. | 0.821 | |||

| Q21. | 0.814 | |||

| Behavioural intention to use CAATs (BI) | Q22. | 0.926 | 0.939 | 0.837 |

| Q23. | 0.894 | |||

| Q24. | 0.924 | |||

We dropped items Q4, Q11 and Q19 from this study as their outer loading is below the threshold of 0.70 (Hair, Hult, Ringle, & Sarstedt, 2017). In terms of composite reliability, all values were meet or exceed the threshold of 0.70, suggesting a good level of of internal consistency reliability. Finally, the average variance extracted values for all variables were larger than 0.50 and the all scale composite reliabilities exceed 0.60, providing evidence for good level of convergent validity of measures (Gonzalez et al., 2012).

Discriminant validity captures the level to which the latent variable is distinct from other variables (Hair et al., 2017). Two approaches are used in this study to assess the discriminant validity, namely, cross-loadings and Fornell-Larcker criterion. The Fornell-Larcker criterion is achieved when the square root of each latent variable’s AVE exceeds the correlations with other variables (Fornell & Larcker, 1981; Hair et al., 2017). As presented in Table 4, all variables explain greater amount of variance with their own than the variance with other latent variables, providing evidence for acceptable discriminant validity. We also assess discriminant validity by checking whether the strength of item loadings on its intended variable is higher than on other variables as presented in Table 5. All variables exhibit higher loadings on their intended variable than on any other latent variable, indicating further evidence for acceptable discriminant validity.

| Table 4 The Ave Square Root | |||||

| BI | EE | FC | PE | SI | |

| BI | 0.915 | ||||

| EE | 0.597 | 0.873 | |||

| FC | 0.813 | 0.737 | 0.834 | ||

| PE | 0.911 | 0.730 | 0.610 | 0.839 | |

| SI | 0.659 | 0.723 | 0.832 | 0.480 | 0.869 |

| Table 5 Item Cross-Loadings | |||||

| Survey items | Performance expectancy | Effort expectancy | Social influence | Facilitating conditions | Behavioral intention to use CAATs |

| Q1. | 0.826 | 0.529 | 0.280 | 0.455 | 0.479 |

| Q2. | 0.847 | 0.581 | 0.361 | 0.493 | 0.497 |

| Q3. | 0.878 | 0.553 | 0.314 | 0.414 | 0.495 |

| Q5. | 0.772 | 0.705 | 0.531 | 0.584 | 0.475 |

| Q6. | 0.871 | 0.689 | 0.515 | 0.604 | 0.588 |

| Q7. | 0.697 | 0.871 | 0.595 | 0.601 | 0.525 |

| Q8. | 0.616 | 0.872 | 0.584 | 0.605 | 0.463 |

| Q9. | 0.591 | 0.879 | 0.685 | 0.664 | 0.522 |

| Q10. | 0.642 | 0.869 | 0.655 | 0.693 | 0.563 |

| Q12. | 0.428 | 0.878 | 0.730 | 0.665 | 0.515 |

| Q13. | 0.366 | 0.638 | 0.820 | 0.673 | 0.486 |

| Q14. | 0.437 | 0.632 | 0.885 | 0.734 | 0.539 |

| Q15. | 0.435 | 0.618 | 0.893 | 0.776 | 0.629 |

| Q16. | 0.415 | 0.553 | 0.868 | 0.750 | 0.569 |

| Q17. | 0.475 | 0.581 | 0.788 | 0.842 | 0.632 |

| Q18. | 0.635 | 0.686 | 0.700 | 0.853 | 0.657 |

| Q20. | 0.315 | 0.542 | 0.726 | 0.813 | 0.641 |

| Q21. | 0.590 | 0.638 | 0.581 | 0.826 | 0.762 |

| Q22. | 0.511 | 0.513 | 0.662 | 0.807 | 0.925 |

| Q23. | 0.642 | 0.618 | 0.575 | 0.751 | 0.896 |

| Q24 | 0.521 | 0.521 | 0.563 | 0.657 | 0.924 |

Results

Structural Model

In this section, we analyse the influence of independent variables on internal auditor’s intention to use CAATs. Table 6 provides the results for the main effect model. The adjusted Rsquared is 0.677, suggesting that 67.7% of the variance in intention to use CAATs can be illustrated by the independent variables included in the structural model. Statistical significance of path coefficients is determined using bootstrapping technique (5000 re-samples).

H1 predicts that performance expectancy affects positively the internal auditors' intentions to use CAATs. The result shows that the estimated path coefficient is positive and significant (β=0.262, p=0.026), providing support for H1. Likewise, H2 suggests that effort expectancy play a vital role in affecting the internal auditors' intentions to utilize CAATs. The path coefficient for EE is insignificant (β=-0.172, p=0.220). Therefore, H2 is not supported in this study. H3 predicts that social influence creates pressure on internal auditors to adopt CAATs. However, the path coefficient for SI is positive but is not statistically significant (β=0.030, p=0.837). Therefore, H3 is not validated. Finally, our analysis shows strong evidence that facilitating conditions have significant effect on internal auditors' intentions to utilize CAATs (β=0.754, p=0.000), providing support for H4.

Additional analysis

Venkatesh et al. (2003) indicate that age, gender, years of experience and voluntariness of use moderate the effects of independent variables on the internal auditors' intentions to adopt CAATs. For instance, men are more likely to adopt new technology when they perceive it to help them with performing better. On the other hand, women with little experience tend to be more influenced by social influence and effort expectancy than men. Likewise, the UTAUT model suggests that younger employees are more likely to use a new technology in order to get pay raises, or to receive higher bonuses and benefits. By contrast, older employees place more emphasize on social influences and effort expectancy than younger employees. Additionally, the UTAUT model predicts that experienced employees will find several paths for aid and support throughout the firm, resulting in greater intention to use the new technology (Venkatesh et al., 2003). In unreported analyses (available upon request), we find no evidence to support such moderating factors.

Discussion of Results

This paper empirically investigated a model combined with the factors affecting internal auditors' intentions to use and accept CAATs. Unlike most of prior studies, the current paper explores the underlying drivers that increased or decreased the likelihood of accepting and using CAATs by internal auditors in Jordan with an unfavourable institutional environment and weak corporate governance mechanisms. Such evidence is particularly important to regulators, audit committees and practitioners as they are struggling to improve the quality of internal audit department. The empirical results supported the predictions of H1and H4. Meanwhile, H2 and H3 were not supported.

Specifically, the regression analyses show that the effect of performance expectancy, as predicated by H1, was statistically significant in explaining the intention of internal auditors to adopt CAATs. This result is consistent with Bierstaker et al. (2014); Curtis & Payne (2014); Mahzan & Lymer (2014), but conflict with the finding of Gonzalez et al. (2012). This result suggests that internal auditors are more willing to utilize CAATs when they perceive that the benefits obtained from the use of these automated tools would improve their job efficiency. Thus, management that seeks to increase CAATs usage should invest more in training programs to educate internal auditors about the benefits of utilizing such tools and to help them remain current with changing technology (Bierstaker et al., 2014).

In accordance with previous research (Curtis & Payne, 2014; Mahzan & Lymer, 2014), we find that effort expectancy is insignificant. The reasons for the insignificant result may be because most of internal auditors in our sample are young and have high level of proficiency in information technology. Therefore, internal auditors may view that the degree of ease accompanying with use of CAATs as relatively unimportant to their decision. Another interpretation for the insignificant result is that in an auditing context, the effectiveness of audit procedures is given a high priority by internal auditors when making technology usage decisions, rather than the personal preferences concerning the efforts required to use the technology (Bierstaker et al., 2014).

Contrary to our expectation, the finding shows that social influence is insignificant, meaning that that decision to use CAATs is not affected by the social pressure arising from the head of internal audit department, or their peers within the firms, or from the professional accounting bodies. In this context, Venkatesh et al. (2003) find that social influence factor is significant in mandatory setting whereas in voluntary setting, it is not significant. In Jordan, CAATs usage is voluntary, even though numerous scholars and professional standards encouraged auditors to use CAATs. In addition, Mahzan & Lymer (2014) noted that the degree of enforcement and monitoring of compliance with CAATs usage is weak, which, in turn, makes internal auditor free to perform context specific decisions on adoption. Consequently, voluntariness of use has no effect on the intention to use CAATs. Overall, the evidence is inconsistent with Curtis & Payne (2008) and Gonzalez et al. 2012), but is in line with Bierstaker et al. (2014), Curtis & Payne (2014), and Mahzan & Lymer (2014).

Similar to Bierstaker et al. (2014) and Mahzan & Lymer (2014), we find evidence supporting the notion that facilitating condition positively influences the internal auditors' intentions to use and accept CAATs. The result suggests that firms should invest enough money in state-of- the-art infrastructure to mitigate the barrier of auditors from accepting and utilizing CAATs. Furthermore, firms may increase CAATs usage though developing new policies regarding hiring and promotion of auditors. These policies should dedicate more weight to auditor’s ability to use data analytics in their day-to-day audit activities.

Conclusion, Implications and Future Work

The importance of the role of CAATs in the audit process is widely recognized. Yet despite their expected benefits and suggestions from scholars and regulators, numerous internal auditors do not currently adopt these tools when conducting various internal audit functions (Dias & Marques, 2018). Borrowing from information systems research, we use the UTAUT model to examine the determinants of CAATs adoption by internal auditors in Jordan. After surveying 105 internal auditors, this study finds that the important factors which may affect internal auditors' intentions to use CAATs are facilitating conditions and performance expectancy. However, both of effort expectancy and social influence are found to be insignificant.

The findings in this study may have important implications to both practitioners and regulators in Jordan. First, CAATs can aid in improving the quality of financial statements within the firms because they are effective techniques in detecting fraud and misappropriation of assets. Hence, firms can utilize the factors identified in our study to encourage the acceptance and usage of such techniques. Thus, increasing the likelihood of discovering material misstatements in financial statements. As discussed earlier, firms can expand CAATs usage by educating internal auditors as to the benefits of using these automated tools, by dedicating more recourse to invest in technical infrastructure, by improving their skills through increased CAATs training programmes, and by developing reward systems that encourage auditors to use CAATs. Second, given that the decision to accept and use CAATs is voluntary, firms should recognize the consequences of their policies and culture on internal auditors’ intention to adopt CAATs (Curtis & Payne, 2014). Lastly, our study suggests the investing in audit software, without considering the barriers to the adoption of CAATs, may limit the desired effects of these automated tools.

Our research is not without limitations. Prior research indicate that trust play a pivotal role technology adoption decision (Kesharwani & Bisht, 2012; Lee et al., 2011; Lin, 2011; Ratten, 2014). Thus, one of the limitations in this study is that we do not consider other factors that may affect internal auditors’ intention to adopt CAATs. Hence, scholars could extend this study by incorporating the trust into the empirical model. By doing so, they can offer a more comprehensive picture on the issue of CAATs adoption. Nevertheless, we believe that our study provides valuable insights onto how to increase CAATs adoption by internal auditors in Jordan.

References

- Ahmi, A., & Kent, S. (2012). The utilisation of generalized audit software (GAS) by external auditors. Managerial Auditing Journal, 28(2), 88-113.

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179-211.

- Ajzen, I., & Fishbein, M. (1980). Understanding Attitudes and Predicting Social Behavior. Pearson Education, Inc.

- Al-Akra, M., Jahangir Ali, M., & Marashdeh, O. (2009). Development of accounting regulation in Jordan. International Journal of Accounting, 44(2), 163-186.

- Arens, A.A., Elder, R.J., & Beasley, M.S. (2012). Auditing and assurance services: An Integrated Approach (Fourtheenth Edition). Pearson Higher Ed.

- Azmi, A., Sapiei, N.S., Mustapha, M.Z., & Abdullah, M. (2016). SMEs’ tax compliance costs and IT adoption: the case of a value-added tax. International Journal of Accounting Information Systems, 23, 1-13.

- Bierstaker, J., Janvrin, D., & Lowe, D.J. (2014). What factors influence auditors’ use of computer-assisted audit techniques? Advances in Accounting, Incorporating Advances in International Accounting, 30(1), 67-74.

- Braun, R.L., & Davis, H.E. (2003). Computer-assisted audit tools and techniques?: analysis and perspectives. Managerial Auditing Journal, 18(9), 725-731.

- Carlson, K.D., & Herdman, A.O. (2012). Understanding the Impact of Convergent Validity on Research Results. Organizational Research Methods, 15(1), 17-32.

- Chin, W.W., Marcelin, B.L., & Newsted, P.R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information Systems Research, 14(2).

- Cigna, G.P., & Sigheartau, A. (2016). Corporate Governance in Transition Economies Jordan Country Report. European bank for reconstruction and development.

- Coderre, D. (1999). Computer-assisted techniques for fraud detection. The CPA Journal, 69(8), 57–59.

- Compeau, D.R., & Higgins, C.A. (1995). Computer self-efficacy: Measure and initial development of a test. MIS Quarterly, 19(2), 189-211.

- Cramer, R.D. (1993). Partial least squares (PLS): Its strengths and limitations. Perspectives in Drug Discovery and Design, 1(2), 269-278.

- Curtis, M.B., & Payne, E.A. (2008). An examination of contextual factors and individual characteristics affecting technology implementation decisions in auditing. International Journal of Accounting Information Systems, 9(2), 104-121.

- Curtis, M.B., & Payne, E.A. (2014). Modeling voluntary CAAT utilization decisions in auditing. Managerial Auditing Journal, 29(4), 304-326.

- Davis, F.D. (1989). Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13(3), 319-340.

- Davis, F.D., Bagozzi, R.P., & Warshaw, P.R. (1992). Extrinsic and Intrinsic Motivation to Use Computers in the Workplace. Journal of Applied Social Psychology, 22(14), 1111-1132.

- Debreceny, R., Lee, S.L., Neo, W., & Toh, J.S. (2005). Employing generalized audit software in the financial services sector: Challenges and opportunities. Managerial Auditing Journal, 20(6), 605-618.

- Dias, C., & Marques, R. P. (2018). The use of computer-assisted audit tools and techniques by Portuguese internal auditors. 2018 13th Iberian Conference on Information Systems and Technologies (CISTI), 1–7.

- Ernst & Young. (2015). The future of assurance: How technology is transforming audit. https://doi.org/10.1097/00002508-198602020-00001

- Fornell, C., & Larcker, D.F. (1981). Structural equation models with unobservable variables and measurement error?: Algebra and statistics. Journal of Marketing Research, 18(3), 382-388.

- Ghosh, A., & Pawlewicz, R. (2009). The impact of regulation on auditor fees: Evidence from the Sarbanes-Oxley Act. Auditing, 28(2), 171-197.

- Gonzalez, G.C., Sharma, P.N., & Galletta, D.F. (2012). The antecedents of the use of continuous auditing in the internal auditing context. International Journal of Accounting Information Systems, 13(3), 248-262.

- Hair, J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2017). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM) (2nd ed.). Sage Publications.

- IIA. (2018). Computer assisted audit techniques (CAATs). Retrieved from http://proxy.lib.siu.edu/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=31705578&site=ehost-live&scope=site

- Janvrin, D., Bierstaker, J., & Lowe, D. J. (2008). An Examination of Audit Information Technology Use and Perceived Importance. Accounting Horizons, 22(1), 1-21.

- Janvrin, D., Lowe, D. J., & Bierstaker, J. (2008). Auditor Acceptance of Computer-Assisted Audit Techniques. In American Accounting Association Auditing Mid Year Meeting AAA, St Petersburg, FL, p. 1.

- Kesharwani, A., & Bisht, S. S. (2012). The impact of trust and perceived risk on internet banking adoption in India. International Journal of Bank Marketing, 30(4), 303-322.

- KPMG. (2015). Data & Analytics enabled Internal Audit. Retrieved from https://assets.kpmg.com/content/dam/kpmg/pdf/2016/04/DA-Enabled-Internal-Audit-Survey.pdf

- Lee, J., Kim, H.J., & Ahn, M.J. (2011). The willingness of e-Government service adoption by business users: The role of offline service quality and trust in technology. Government Information Quarterly, 28(2), 222-230.

- Li, H., Dai, J., Gershberg, T., & Vasarhelyi, M.A. (2018). Understanding usage and value of audit analytics for internal auditors: An organizational approach. International Journal of Accounting Information Systems, 28, 59-76.

- Lin, H.F. (2011). An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. International Journal of Information Management, 31(3), 252-260.

- Mahzan, N., & Lymer, A. (2008). Adoption of computer assisted audit tools and techniques (CAATTs) by internal auditors: current issues in the UK. In paper presented at BAA Annual Conference 2008 in Blackpool, UK, British Accounting Association, April.

- Mahzan, N., & Lymer, A. (2014). Examining the adoption of computer-assisted audit tools and techniques: Cases of generalized audit software use by internal auditors. Managerial Auditing Journal, 29(4), 327-349.

- Martins, C., Oliveira, T., & Popovi?, A. (2014). Understanding the internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management, 34(1), 1-13.

- Moore, G.C., & Benbasat, I. (1991). Development of an Instrument to Measure the Perceptions of Adopting an Information Technology Innovation. Information Systems Research, 2(3), 192-222.

- Pedrosa, I., & Costa, C.J. (2012). Computer assisted audit tools in real world: Idea applications and approache’s in real context. International Journal of Computer Information Systems and Industrial Management Applications., 4, 161-168.

- Ratten, V. (2014). Behavioral intentions to adopt technological innovations: The role of trust, innovation and performance. International Journal of Enterprise Information Systems, 10(3), 1-13.

- Sayana, S.A. (2003). Using CAATs to support IS audit. Information Systems Control Journal, 1, 21-23.

- Singleton, T. (2006). Generalized audit software: Effective and efficient tool for today’s IT audits. Information Systems Control Journal, 1-3.

- Taylor, S., & Todd, P. (1995). Assessing IT Usage: The role of prior experience. MIS Quarterly, 19(4), 561.

- The World Bank. (2017). Audit data analytics: opportunities and tips. The World Bank. Retrieved from http://siteresources.worldbank.org/EXTCENFINREPREF/Resources/4152117-1427109489814/SMPs_ spreads_digital.pdf

- Thompson, R.L., Higgins, C.A., & Howell, J.M. (1991). Personal computing: Toward a conceptual model of utilization. MIS Quarterly, 15(1), 125.

- Venkatesh, V., Morris, M.G., Davis, G.B., & Davis, F.D. (2003). User acceptance of information technology: toward a unified view. MIS Quarterly, 27(3), 425-478.

- Zuiderwijk, A., Janssen, M., & Dwivedi, Y.K. (2015). Acceptance and use predictors of open data technologies: Drawing upon the unified theory of acceptance and use of technology. Government Information Quarterly, 32(4), 429-440.